We are in a world of ever-evolving change. The war in Ukraine and Covid-19 are just examples of the volatile, uncertain, complex, and ambiguous (VUCA) world[1] that causes a need to adapt strategies, reprioritize risks and allocate resources in a more flexible and pro-active way.

Planning, Budgeting, and Forecasting (PBF) determine and map out the short- and long-term financial and non-financial goals. Examples of the importance of accurate PBF processes are often seen when publicly listed companies disclose their results. Whenever a company does not meet the expected results or needs to adjust its outlook the stock price is often hit sharply. In 2020, SAP’s stock crashed by up to 22% on one day after the company had to adjust the one-year and midterm outlook for the second time within the year.[2] Different studies show that the stock price can suffer for almost a year due to unreliable forecasting. For company-internal players adequate PBF is important to determine the optimal and efficient allocation of budgets and resources as well as to position the company in a competitive environment, like which markets and products to focus on.

Besides old-known challenges like lacking connection between strategic and operative planning or missing objectivity in the plannning process there are now new opportunities and challenges – which are connected to the VUCA – and the increasingly digitized – world. They have an impact on the quality and efficiency of PBF processes. Examples of these are:

- New (digital) business models and (market) disruptions

- Technology (e.g. cloud computing, robotic process automation)

- Advanced data analytics methods – including the analysis of external and unstructured data

- Agile organizations

- Digital work culture and user experience

- Heterogeneous IT systems

This Point of View will outline why traditional planning and alternative approaches (e.g. Beyond Budgeting) are no longer adequate to realize the opportunities and address the challenges of this new digital world and why a new approach is needed.

Traditional PBF approaches

A PBF approach that has been predominantly used in the past and is still used in many companies is the traditional planning approach. It is characterized by the following features:

- Static planning (taking last year’s figures as the basis adjusted by predictive factors such as growth or inflation rates)

- Bottom-up orientation

- High coordination effort

- High granularity of plans and budgets

- Often Excel or ERP based (no tool usage)

Today – in the corporate environment characterized by constant change and increased dynamism – traditional planning is perceived as too rigid to serve companies as a target-oriented management tool. It does not consider the pace at which markets move. Traditional planning is especially criticized due to the following issues:

Bad cost-benefit ratio

The traditional approach typically occupies many personnel resources in controlling and other departments over a time period of 6 up to 12 months. Usually, a high number of spreadsheets is used – taking a lot of time to sort out. While the budgets are worked out detailed, they are quickly outdated. Therefore – despite the high amount of work – the results only offer a sham accuracy.

Lack of connection to corporate strategy and cross-functional, digitized integration

The missing connection to other management tools and cross-functional integration causes low reference of the budget to the overall corporate strategy and individual functional measures. There are silos between finance and the business that prevent effective cost management. Furthermore, IT integration is often inefficient as it is in many cases Excel-based, not using a planning tool with digitized interfaces.

Performance measurement difficult

The budgets resemble neither market values or process qualities nor strategic networks within the company. They exclusively represent the financial planning figures at a certain point in time – therefore partially lacking acceptance of managers and not considering the pace at which markets move. Rather than responding to planning problems by enhancing the detail within the forecast it would be beneficial to gain a better understanding of the underlying trends.

Alternative planning approaches

As an answer to the increasing dissatisfaction with the traditional planning approach Robin Fraser, Jeremy Hope, and Peter Bunce developed the so-called Beyond Budgeting approach in the 90’s.[3] In this approach relative goals take the place of fixed budget figures. The aim is to be better than the competition and not fulfill a plan. Decentralization of responsibility aims to focus on flexibility, creativity, and performance incentives. Successful Beyond Budgeting, therefore, means not only changes to the budgeting process, but also demands and promotes a change in the corporate culture. Beyond Budgeting is characterized by 12 key management and performance measurement principles.[4]

Beyond Budgeting never reached the status of a real alternative in corporate practice. Almost no company has (fully) adapted the concept. This is due to the radical nature of the concept and the fact that the principles present a coherent and plausible concept in itself but are comparatively abstract and not very operationalized. Therefore, the implementation of Beyond Budgeting itself means high effort and complexity in conception and implementation.

More successful in corporate practice were different planning improvement proposals which economic science summarized with the term ‘better budgeting’. Among commonly accepted improvement measures are the following:

- Top-down orientation and planning frontloading to connect strategy and planning and reduce planning cycle time

- Value driver models to identify and consider cause-effect relationships

- Interconnected subplans to reduce complexity

- Usage of planning tools to reduce excel-based errors and allow quick simulations and subplan connections

As AdEx Partners we have developed a planning approach building upon these principles as well as our experience in implementing tailored concepts for our clients. The approach with its key principles will be introduced in the following.

AdEx Partners agile and digital planning approach

The goal of the AdEx Partners agile and digital planning approach is to realize the new opportunities and address the challenges described in the introduction helping you to navigate in the new world and provide flexible and accurate PBF processes. The approach is based on the following principles which have proven to help our clients improve their PBF processes:

Decision-based, top-down oriented

A decision-based, top-down oriented approach ensures a stronger connection between strategy and operative planning through the communication of top-down targets and a middle-up validation. Furthermore, the top-down orientation shortens the planning process significantly freeing up resources and allowing to use as up-to-date data as possible. A combination of top-down communicated, strategy-based targets and the elimination of unnecessary, granular details offers decision-relevant and target-based information enabling to plan what needs to be decided.

Integrated and automated

Through integrated and automated planning different processes as well as control levels (esp. functional and financial) and horizons (short-, medium- and long-term) are being integrated. The integration of all business planning activities along with the identification of cause-and-effect relationships in the company's value chain, allows complex what-if analyses. By synchronizing and connecting operational planning activities (e.g., sales, production & capacity planning) with financial result variables in the income statement, balance sheet, and cash flow, discrepancies between financial planning and business processes are being avoided. Furthermore, the implementation of automation logics can support the creation of forecasts and plans. They are typically used to create different scenario plans to simulate the impact of planned product portfolio changes on the financial result or determine the impact of risk scenarios (macroeconomic risks such as currency or GDP fluctuations; microeconomic risks such as a product recall or new regulations; events such as Brexit or trade wars).

Value-driver-based

Value-driver-based planning enables a correct identification of the driver variables and their links, including non-monetary variables. It offers better management of the business and more informed, data-driven decisions regarding strategic actions, like price or volume changes, and risk management. The derivation of value drivers is based on strategic company targets and includes external benchmarking variables. Driver variables are compared and confirmed by stakeholders. A planning tool for easy modeling is useful to realize value-driver-based planning. Being result-oriented, drivers are developed from the result metrics of a company's key strategic objectives such as drivers for revenue growth. The value driver base provides a consistent logic that can be used at multiple planning and reporting levels, at different levels of granularity, and can simplify processes like rolling forecasts. Additionally, the linked driver logic enables additional multi-dimensional root cause analysis and encourages insights from multiple data sources – focusing on both internal and external drivers.

Usage of modern technologies and planning tools

The usage of modern technologies and planning tools offers new analytic possibilities and more efficient processing. For example, cloud-based planning platforms are often easier to operate and maintain than on-premise solutions – also leading to reduced cost. In-memory computing, like S/4HANA, enables fast processing of analyses and forecasts. Plausibility analyses and suggested plan values can be derived through Big Data; patterns and forecasts can be identified based on artificial intelligence. Robotic process automation (RPA) supports the automation of process steps, particularly in processes like data collection, preparation and analysis and their interfaces.

Analytics and scenario planning

Analytics and scenario planning can include a variety of tools reaching from complex statistical models to neuronal networks. External data and drivers such as economic indicators, seasonal impacts as well as own and competing activities are considered. Through analysis of structured and unstructured data patterns can be identified and a system-based derivation of recommendations for actions can be made. Based on these proven patterns predictive analytics are integrated into the planning progress and customized by domain experts as needed.

Rolling, flexible forecast

Rolling and flexible forecasts allow strategy and investment decisions to be constantly adjusted to changing environmental conditions. They are based on a future-oriented horizon that always remains the same. The usual periodicity is quarterly or monthly and can include a combined level of detail in fine and coarse reporting if required. By focusing on the essentials, important monetary and non-monetary content is included. In addition, strategy adjustments and investment decisions based on changing (external) conditions are possible.

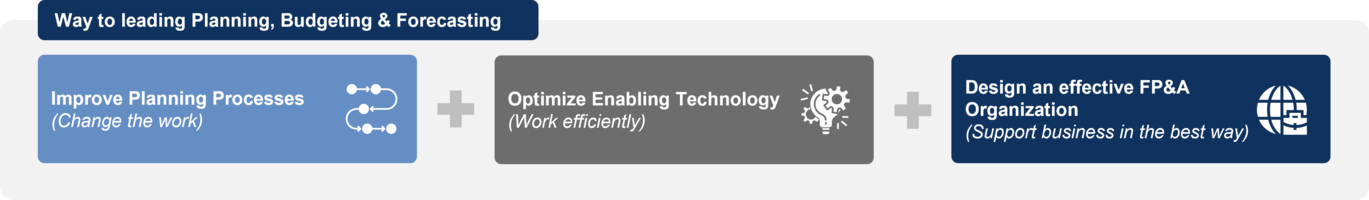

As illustrated in this summary the implementation of an effective and best practice PBF organization and processes should follow a 3-step approach in general – of course considering the interdependencies:

Improve Planning Processes – Change the work

- Improve efficiency of planning cycle/calendar

- Determine appropriate level of detail (e.g. Corporate vs. Business Unit [BU])

- Consider rolling forecasts

- Link plans to strategy with driver-based planning

- Use driver analytics to develop targets and pre-populate plans

- Align and integrate financial and operational plans

- Zero Based Budgeting[5] of General & Administrative Expenses (G&A)

Optimize Enabling Technology – Work efficiently

- Implement a common, leading practice planning application

- Provide for specific BU needs and unique requirements but standardize where possible

- Create a robust & interactive reporting layer suited for Executives & Power Users

- Manage master data

- Ensure efficient data integration

- Ensure ongoing model support

Design an effective PBF organization – Support business in the best way

- Cost-effective & lean Financial Planning & Analysis (FP&A) organization

- Retained FP&A – Only for material, complex & volatile BUs

- COEs – Center of Excellence. Create standards / policies, produce top-down plans; review consolidated plan

- Global Operations – reporting, data integration & first level analysis

- Consider separating compensation from plan / performance to avoid gaming

- Design training programs for FP&A

Footnotes

[1] https://hbr.org/2014/01/what-vuca-really-means-for-you

[2] https://www.handelsblatt.com/finanzen/maerkte/marktberichte/dax-aktuell-ein-schwarzer-montag-fuer-den-dax-sap-aktie-bricht-um-22-prozent-ein/26307802.html

[3] Bunce, P., Fraser, R., & Hope, J. (2003). Beyond budgeting. Horvath, P./Gleich R, 69-86. The development was a result of a taskforce of the industrial association CAM-I (Consortium of Advanced Management, International)

[4] https://corporatefinanceinstitute.com/resources/knowledge/finance/beyond-budgeting/

[5] Zero-based budgeting (ZBB) is a budgeting technique in which all expenses must be justified for a new period or year starting from zero, versus starting with the previous budget and adjusting it as needed

![Jan Heinrichs [Translate to English:] Jan Heinrichs, AdEx Partners](/fileadmin/_processed_/1/1/csm_Heinrichs_Jan_Senior_Manager_8cf5b0f087.jpg)