Before COVID-19, the personal exchange on critical or complex issues could be done quickly and easily vis-a-vis at the office. Now, due to the "imposed" home-office regulations, they are often only digitally possible, either through video and telephone conferences or other collaboration tools. At the same time, many companies – and especially finance and accounting departments – are now realizing that their manual processes can hardly be adapted in times of digital decentralization, which leads to a fundamental rethinking among the decision makers.

Why "Business as usual" is not an option

The Record-to-Report (R2R) processes have rarely been modernized and adapted to current requirements in the past, and only then, if urgently needed. This conventional R2R model condenses a huge amount of work into a short span of time and delays data processing and reporting until the end of the period. This is a reactive approach, and the costs of operating this way are high. It leaves no time for analysis, and the increased risk of error can damage the quality, accuracy, and timeliness of results.

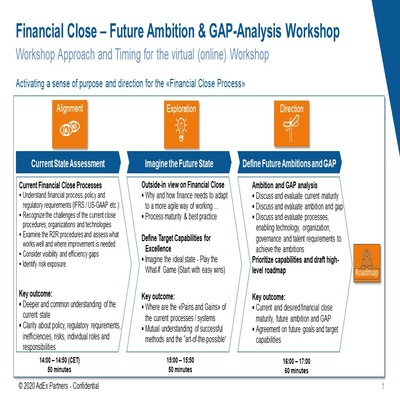

Analysis and approach

The closing process consists of many interdependent steps that are often specified in local "checklists" to manage and coordinate the process. But there are still additional loops at the end of the period, for example to clarify intercompany amounts that don’t match or incorrectly assigned accounts. This is in principle not complicated, but especially in times of imposed home-office requirements, these "individual" coordination processes across different time zones, cultures and under significant time pressure often leads to an incredible turmoil. For many companies, the question therefore arises as to how these tasks, that require a fast and precise execution, can be performed remotely with the same quality.

So now there is a growing willingness among CFOs to step up process analysis and optimizations for the "digitization and decentralization of financial closing", to accelerate the implementation and to simplify, standardize and automate the processes.

Tips and tricks for your everyday work

1. Check the necessity of data collection

Often, reports have been produced for years that no longer offer (sufficient) added value due to changed requirements. At the same time, however, the data collection effort is often particularly high in this area.

2. Avoid separate spreadsheets

Local spreadsheets and checklists are always time-consuming, lack overall transparency and are prone to errors. Try to integrate such spreadsheets into existing systems. If nothing is available for this: There are already standard tools as well as the possibility of extending existing consolidation solutions and collaborative add-ons for ERP solutions.

3. Standardize, control and optimize your processes

Standardise your processes and simplify individual intermediate steps wherever possible. Use validation mechanisms and automated controls. Work with clear, transparent flow charts, clearly assigned responsibilities and document the processes.

4. Standardize the scope of the monthly closing

The requirements for the monthly financial statement often vary from those for quarterly, semi-annual or annual financial statements. Standardize the monthly closing process and supplement the checklists with additional requirements for quarterly, semi-annual, and annual closing procedures. Develop a methodology that distributes processes that traditionally take place at the end of the month or at the end of the respective period continuously over the period.

5. Automate repetitive and error-prone processes

Many activities in the closing process are repetitive. Take advantage of the automation potential available and automate repetitive, high-volume and error-prone processes - including the clearing of open items. RPA solutions are just as suitable for this as purpose built financial applications. They free up resources, which in turn leads to a significant improvement in quality - a win-win situation.

We also recommend a switch to a digital document flow, "one single source of truth" and real-time reporting. Because: If documents can be processed directly and in one common data source and evaluated promptly, the closing process can also be carried out remotely, quickly and with high quality.

Many of our recommendations sound self-evident - and yet are not always implemented in reality. With the help of our structured workshop concept, we are happy to help you activate the biggest levers in simplifying your closing processes.